These proposed developments will require additional Katy ISD school buses navigating in an area already congested, placing school children at risk. These developments, if allowed to proceed, will create a demand that will further exacerbate the current shortage of teachers and shortage of drivers with no additional funding.

Chris Culberson – September 19th, 2022

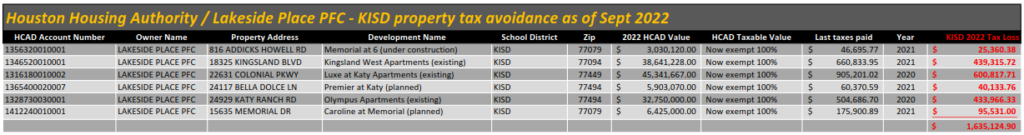

ANNUAL KISD property tax-avoidance (for 75 or 99 years!)

In reviewing HHA’s proposed meeting agenda for Monday, Sept 19th, several topics stand out to me. The first being within the executive (closed) session. Reading sections 551.071, 551.072 and 551.074 of the Texas Government Code (see https://statutes.capitol.texas.gov/SOTWDocs/GV/htm/GV.551.htm), it’s obvious they are keeping their real estate deals out of the public eye and may even be fighting related litigation.

The other topics that caught my eye are resolutions 3520 and 3521. 3520 is yet another new HHA apartment development in Katy that will also avoid paying any taxes into KISD. This now makes 6 tax exempt HHA projects in KISD I have been able to identify. 3521 highlights their other strategy of buying up existing for-profit apartments and gaining tax exempt status under the same guise of affordable housing.

It took some digging but I have found dozens of these HHA/Lakeside Place PFC acquisitions around town, several very close to us. Keep in mind half of the six property values reflect the undeveloped taxes so the revenue loss to KISD will rise significantly once the projects are built. None of this passes the smell test with me.

September 12th, 2022 – Vincent Palmisano

Update on my actions:

1. I have emailed every KISD board member to express concerns about Houston Mayor dictating tax exemptions negatively affecting KISD schools. Greg Schulte responded with the following, sounds like they are getting a bit more proactive. Can we add to KISD section of the website to encourage other parents to email KISD officials to express their outrage as well, they can copy and paste my email for convenience.

“Mr. Palmisano – We are aware of this, and are exploring what, if any options, we have.

Regards,

Greg Schulte

Katy ISD

Board of Trustees

GregSchulte@katyisd.org

713.306.1454 – Cell”

_____________________________________

Greg, I want to bring a troubling situation to your attention. Did you know that the Houston Housing Authority, 100% elected by Houston Mayor Turner with no oversight from City Council, are giving developers sweetheart deals which are property tax exempt under the guise of affordable housing? There are two major projects zoned to KISD (1.Memorial at Six- in the 800 Block of Addicks-Howell, 2. Caroline at Memorial- on the former Kickerillo property) which will have 650 plus apartment units and thousands of students which will not contribute a penny to KISD taxes. I do not believe Katy School district should allow Mayor Turner carte blanche to waive an estimated $3M/year in taxes that Katy schools desperately need. As a tax paying homeowner with children actively attending KISD this is very troubling. I ask that the KISD board investigate this matter further, details in links below, there are serious negative ramifications to our KISD community. Houston’s Housing Racket? – YouTube: https://www.youtube.com/watch?app=desktop&v=-j0736lRXxc&feature=youtu.be West Houston Developments ? All we know About the Apartment Developments https://westhouston.info/ Thank you, Vincent Palmisano 281-435-1975

2. Environmental. My contact who consults for Harris County Flood Control District (HCFCD) confirmed that we should engage with Buffalo Bayou Partnership (BBP) and Katy Prairie Conservancy. He also gave me a contact Jim Blackburn, a professor at Rice University in involved with BBP as part of the Baker Institute. blackbur@rice.edu. I plan to call Jim and contact BBP this morning; will keep posted on responses. Jim would be a solid expert environmental consultant to engage via Dolcefino Consultants or thru our Legal team (if we get to that point).

3. Legal: a) I reached out to two of my Litigator pals to get counsel on this matter. Rob Horn, https://www.pandmllp.com/about-us/robert-horn/. PMR thinks there is a high probability that we could find “cause” for an injunction. Here is a breakdown of back of the envelope “costs estimates” which could easily reach $300k. Disclaimer: This is not a firm quote. $100k temporary injunction, $100k experts retained (environmental, hydro, traffic) and get opinions,

another $100k to go to trial. PMR is available this week if we want to speak with them. Let me know and I can arrange a 30-minute call. Fun fact: Rob Horn lives down the street from Dolcefino.

b). Other litigator’s opinion: Total costs easily $500k. Might be able to get an injunction, but it would depend on the facts of the case. The first step would be a temporary injunction to preserve the status quo. If granted, then there would be a trial on whether to issue a permanent injunction.

Costs sound high but not so bad considering this would be spread across 1k plus individuals, and the potential value deterioration of our homes.

***I deliberately did not provide any details as it could be made “discoverable” if this goes to litigation, and we don’t want counter party knowing our legal tactics. We should refrain from documenting any legal tactics in our emails or on the website. Any communication with Counsel would of course, be privileged and protected.

~Vincent

September 8th, 2022

Sarah Truby, Anthony Choueifati and Steve Wormald all received “carbon copies” of this reply from Ken Gregorski, KISD:

Ken Gregorski

Mr. Wormald, I understand your position about the multifamily complexes near your neighborhood. I have asked for a legal opinion from our outside attorney who assists the District with property matters. In summary, there is no procedural mechanism by which the District can challenge or disregard the tax exemptions granted to the PFC, since the exemptions are mandated by the legislature under the Texas Local Government Code. Furthermore, there is not a legal mechanism available for the District to stop the development of the public housing projects. I agree that it is unfortunate that the District cannot collect property taxes when this happens, but that is a function of the government and the laws that impact us.

Sincerely, Ken Gregorski, Ed.D., Superintendent Katy Independent School District – KennethGregorski@KatyISD.org

281-396-2304

The emails below seem to be a classic example of passing the buck with a “you-handle-this” attitude. If I were a Katy ISD parent, I’d be very concerned about this apparent indifference to this tax revenue situation (See TAXATION) and suggest you IMMEDIATELY write to each Trustee and Supt. Gregorski and express your concerns; You can reach each Board Member directly by email in the style below for Dawn Champagne, rather than mess with their webmail. Their names are listed HERE

September 5th, 2022

Seve – Thanks for your email…I will look into this.

Greg Schulte – Katy ISD – Board of Trustees

713.306.1454 – Cell

September 4th, 2022

I received the following from Trustee Dawn Champagne – DawnChampagne@katyisd.org

I will forward your email to Dr. Gregorski. I am not sure if there is much we can do about this?

Thank you, Dawn Champagne, Katy ISD BOT

September 2nd, 2022

No other response was received, so I followed up to each Trustee individually through their webmail system, with the following:

” I am contacting you on behalf of the West Houston Apartments Group. As we have informed you via Dr. Gregorski, one of the many concerns we have with the two new apartment developments, together with the re-use of BP Westlake 3 office to apartments, is that almost 1,000 multi-family dwellings are being added to KISD in the Energy Corridor. Because the developments have been granted tax-exemption, no revenue to KISD and Harris County will be derived from these developments – lost revenues in the amount of $2,700,000 per year for 75 and 99 years. Your constituents are concerned that KISD is apparently making no effort to forestall this and support our efforts, and we would sincerely appreciate that support. Thank You

August 18th, 2022

eMail sent to Dr. Ken Gregorski, KISD Superintendent. Eventually, after some follow up calls, I received the following email in response:

“Mr. Wormald,

It is my understanding that you are trying to get some information to our Board of Trustees. Perhaps I can provide some assistance. I have copied the Board of Trustees Secretary for Board Services, Debbie Davies. If you would like to submit documents directly to Mrs. Davies, she will ensure all Board members receive any information you would like to provide.

Sincerely, Ken Gregorski, Ed.D. – Superintendent

Katy Independent School District

281-396-2304